Business Debt Help in Northern Ireland

If your company is experiencing mounting debt, falling trade, or increasing pressure from HMRC, taking professional business insolvency advice at the earliest possible opportunity is vital.

Whether you’ve set up as a sole trader or are operating as a limited company, ensuring a healthy cash flow is crucial to the long-term success of your business. Lack of cash is one of the main causes of business failure, even for those companies which have been profitable in the past.

When insolvency threatens, it is vital you know your options available to companies in Northern Ireland to ensure you make the best choice for both yourself and your business.

Fees apply. May not be suitable in all circumstances. Your credit rating may be affected.

MoneyHelper is a free independent service available to customers offering debt counselling, debt adjusting and providing of credit information services.

Fees apply. May not be suitable in all circumstances. Your credit rating may be affected.

MoneyHelper is a free independent service available to customers offering debt counselling, debt adjusting and providing of credit information services.

Understanding Limited Company Insolvency in Northern Ireland

When you can’t pay your company’s bills as and when they fall due, this may be an indication that the business could be insolvent.

This doesn’t mean that this is the end of the road for your company, however. With so many effective insolvency procedures available to limited companies in Northern Ireland, you may be able to get your business back on track with the guidance of a licensed insolvency practitioner.

In the majority of cases, company directors will benefit from limited liability in the event of the company’s insolvency, meaning they will not be held responsible for paying the debts of the business. This is because, legally, a company is seen as a separate entity from its director(s).

However, this does not mean that you do not need to address your business’s financial concerns. No matter how bad you feel the situation is, there is a solution out there to help solve the issues you are currently facing. It is vital that you speak to a licensed insolvency practitioner as soon as your company begins to experience financial difficulties.

Insolvency Options for Limited Companies in Northern Ireland

An insolvency practitioner will be able to talk you through the different options which may be open to you and your business and recommend the most appropriate course of action. Insolvency procedures come in various forms; some aiming to rescue the business, while others help you bring your company to a formal end.

If you believe your business would be able to turn a good profit if only it wasn’t battling against its current debt problems, you may be able to consider a formal insolvency procedure called a Company Voluntary Arrangement (CVA).

In its simplest terms, a CVA is a legally-binding formal repayment plan a company enters into with its creditors. This allows for the outstanding debt to be cleared through a series of affordable monthly instalments, instantly easing cash flow pressure and allowing trade to continue. The idea is that current debts are paid using future profits; this means that only those businesses which have a realistic prospect of achieving future profitability will be able to consider this type of procedure.

Unfortunately, sometimes a company’s financial problems are at such a level where there is no option but to cease trading and wind up the company’s affairs in an orderly manner. An insolvency practitioner will be able to place your company into liquidation through a process known as a Creditors’ Voluntary Liquidation (CVL). The appointed insolvency practitioner will gather all the company’s assets including cash at bank, sell any physical property, and distribute the proceeds to outstanding creditors. Any debts remaining after this will be written off and the company will be struck off the register held at Companies House.

Advice for sole traders and company directors in Northern Ireland

If you are alerted to potential problems early enough, there are a number of ways to protect yourself and your business from closure. Here are a few tips to help:

Understand the mechanics of your business

It’s the underlying systems and procedures used every day that will help you stay in control. Regular invoicing and payment collection are just two areas that require efficient processes to be in place if you’re to maximise cash availability. If you understand why poor credit control exposes your business to the risk of bad debt, for example, it’s less likely to affect your business to the point of serious financial decline.

Seek professional insolvency advice

Licensed insolvency practitioners offer in-depth business knowledge and industry experience, and often have contacts with alternative lenders offering flexible finance deals. It’s possible to seek professional insolvency advice at any stage of business development, not only in cases of dire need.

Start-up businesses and established organisations alike can benefit greatly from the commercial acumen and industry experience offered by a licensed insolvency practitioner, and ensure the decisions made are based on professional guidance.

Forecast your cash flow regularly

Cash flow forecasts offer valuable insight into your cash needs over the coming months. They can be used to avoid shortfalls and identify cash surpluses, allowing you to plan a growth strategy or simply remain confident that you can pay the bills.

How We Can Help

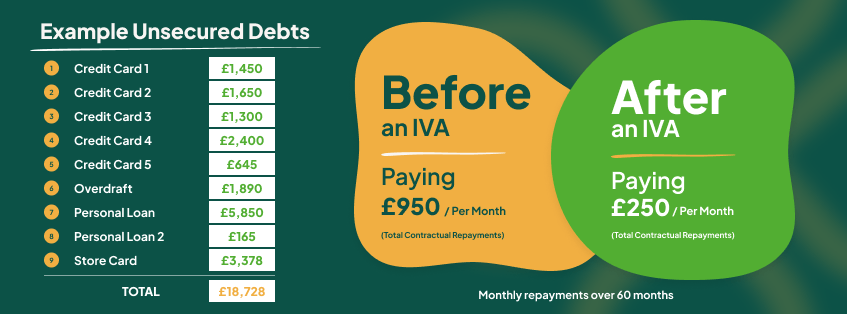

When it comes to personal debt, there are a number of formal debt solutions which can be used to help you manage the money you owe; from Individual Voluntary Arrangements (IVAs), through to Bankruptcy in the most serious cases. We also provide insolvency solutions for businesses debts, including rescue and closure options. The team at Northern Ireland Debt Solutions can help you understand all of your options, before working alongside you to put a plan in place to help you move forward.

Helping Residents of Northern Ireland in Debt Since 1989

The team at Northern Ireland Debt Solutions are dedicated to supporting individuals through their most trying financial times. If you have debts over £5,000, live in Northern Ireland, and are ready to tackle your debt problems, we can help.

We understand that everyone’s experience with debt is different, and that is why we pride ourselves on treating every customer as the individual they are. Our specialist debt advisers will take the time to understand your situation, and work alongside you to put a plan in place which is both affordable and manageable.

For over thirty years we have been providing help, guidance, and support to individuals in debt, and we are here to help you too.

.

Get Started – Contact The Team Today

Ready to take the first step to a brighter future? Contact Northern Ireland Debt Solutions today to understand your next steps.