Debt help options in Northern Ireland

If you are struggling under the weight of unmanageable debt, there are a number of solutions out there which could help you get back on a solid financial footing.

When it comes to solving problem debt, there is not a one size fits all solution. There are various options out there, and it is important to gain a thorough understanding of each one before committing to a particular route. This is where the team at Northern Ireland Debt Solutions are perfectly placed to help.

At Northern Ireland Debt Solutions, we offer three main options – Individual Voluntary Arrangement and Bankruptcy:

Fees apply. May not be suitable in all circumstances. Your credit rating may be affected.

MoneyHelper is a free independent service available to customers offering debt counselling, debt adjusting and providing of credit information services.

Fees apply. May not be suitable in all circumstances. Your credit rating may be affected.

MoneyHelper is a free independent service available to customers offering debt counselling, debt adjusting and providing of credit information services.

Understanding Debt Solutions in Northern Ireland

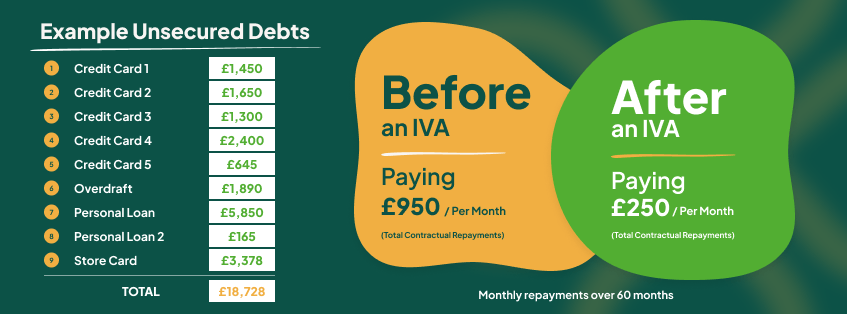

- Individual Voluntary Arrangement (IVA)– You will make one single monthly payment for a set time, typically 5 years. After this time, any remaining unsecured debt is written off.

- Bankruptcy– This is the most serious debt solution, however, in certain circumstances it does represent the best option. With bankruptcy, all of your unsecured debt is written off, however, a record of the bankruptcy will remain on your credit file for six years making it extremely difficult to obtain future credit and could even impact on your job.

Debt Help in NI

With over 25 years’ experience in the personal debt market, there is nothing we have not seen before. No matter how bad you feel your situation is, rest assured there is a solution out there which can help.

Through an initial consultation, our professional advisers will take the time to understand your financial issues, and recommend a debt solution which best suits your situation. After all, what may be the right option for one person could be the completely wrong choice for others. During this initial consultation we will also help to put your mind at rest by answering any questions you may have.

How We Can Help Support You With Your Debts

At Northern Ireland Debt Solutions we are dedicated to helping individuals navigate their way through unmanageable debt and periods of financial distress. No matter how bad you believe your situation to be, rest assured there is a solution out there to help.

If you have debts over £5,000, live in Northern Ireland, and would like to know more about your debt options, we can help.

How We Can Help

When it comes to personal debt, there are a number of formal debt solutions which can be used to help you manage the money you owe; from Individual Voluntary Arrangements (IVAs), through to Bankruptcy in the most serious cases. We also provide insolvency solutions for businesses debts, including rescue and closure options. The team at Northern Ireland Debt Solutions can help you understand all of your options, before working alongside you to put a plan in place to help you move forward.

Helping Residents of Northern Ireland in Debt Since 1989

The team at Northern Ireland Debt Solutions are dedicated to supporting individuals through their most trying financial times. If you have debts over £5,000, live in Northern Ireland, and are ready to tackle your debt problems, we can help.

We understand that everyone’s experience with debt is different, and that is why we pride ourselves on treating every customer as the individual they are. Our specialist debt advisers will take the time to understand your situation, and work alongside you to put a plan in place which is both affordable and manageable.

For over thirty years we have been providing help, guidance, and support to individuals in debt, and we are here to help you too.

.

Get Started – Contact The Team Today

Ready to take the first step to a brighter future? Contact Northern Ireland Debt Solutions today to understand your next steps.